Location : Timmins, Ontario, Canada.

Products : Silver & Gold.

Ore Type: The Dome Mountain area has numerous gold bearing quartz-sulphide veins.

El Chino Copper Mine

|

El Chino Copper Mine |

Location: Santa Rita, New Mexico, United States.

Products: Copper Deposit.

Ore Type: Porphyry copper deposit with

adjacent copper skarn deposits.

Host

rocks: The predominant oxide copper mineral is chrysocolla.

Chalcocite is the most important secondary copper sulfide mineral, and

chalcopyrite and molybdenite

the dominant primary sulfides.

Geological

setting: The Cobre

Mountains are composed of Proterozoic metamorphic and igneous rocks covered by

about 3800 to 4800 feet of Paleozoic to Mesozoic sedimentary rocks. Cretaceous

diorite to quartz diorite sills subsequently intruded these older rocks.

Shortly thereafter, mafic to intermediate composition dikes and other intrusive

bodies were emplaced and 2000 feet of intermediate composition lavas and breccias

were erupted onto the surface. Next, the large granodioritic

plutons at Chino and at Hanover-Fierro to the north were intruded. The last

stage of intrusive activity in this area was the emplacement of rhyolitic

dikes. The multiple intrusions locally domed and folded the older Paleozoic and

Cretaceous strata.

Mineralization: Porphyry

copper deposit are low-grade (<0.8%) disseminated deposits of copper

found in and around small intrusive bodies composed of porhyritic

diorite, granodiorite, monzonite or quartz monzonite (McLemore, 2008). The

small plutons (also called stocks) are often shallowly emplaced at depth within

1 to 6 km of the earth's surface. The copper occurs within breccia or in

networks of fractures, both in the porphyritic intrusion and in the adjoining

country rocks.

Cadia-Ridgeway Mine

Location: Orange, New South Wales,is one of three gold mines Newcrest currently operates in Australia.

Products: Copper & Gold. A series of large underground and open-cut gold and copper mines

Ore Minerals: Ore minerals are native gold, chalcopyrite and bornite, mostly occurring within veins, but also disseminated. Magnetite is a major accessory mineral in veins. Hydrothermal alteration associated with the strongest mineralisation is potassic: orthoclase, albite, actinolite, magnetite, biotite. This is overprinted by later propylitic assemblages: epidote, chlorite, Fe-carbonate, calcite, hematite dusting.

Geological

setting: The Cadia

deposits are part of a Late Ordovician – Early Silurian porphyry alteration-mineralisation

system that extends over an area of at least 6 X 2 km within the Ordovician Molong

Volcanic Belt of the Palaeozoic

Lachlan Fold Belt (Newcrest Mining Staff, 1997). The Molong

Volcanic Belt comprises a suite of intermediate to basic volcanics,

volcaniclastics,

comagmatic

intrusions, and limestones. The

suite is probably part of a subduction-related island arc disrupted by later

tectonism (Glen et al, 1997). In the Cadia

area the volcanics

and intrusions are shoshonitic

(Blevin,

1998).

Mineralization: Sheeted quartz vein, stockwork quartz vein, disseminated and skarn, all of which are genetically related to a relatively small (3 X 1.5 km in outcrop) composite intrusion of predominantly monzonitic composition, with a monzodioritic to dioritic rind (Cadia Hill Monzonite). The Cadia Hill Monzonite intruded Forest Reefs Volcanics (volcaniclastics, lavas, subvolcanic intrusions, and minor limestone) and Weemalla Formation (siltstone, mudstone, minor volcaniclastics). Emplacement of the Cadia Hill Monzonite was probably facilitated and localised by the development of a major north-west (NW) to south-east (SE) trending dilational structural zone, which is well evident in magnetic data.

Bonikro Gold Mine

|

| Bonikro Gold Mine |

Location: Bonikro, Côte d’Ivoire.

Product: Gold.

Ore Type: Disseminated

Geological Settings & Mineralization: The Bonikro deposit is hosted primarily within a small granodiroite intrusion. Mineralisation extends into surrounding basalts to the south, and is controlled along a moderately dipping shear zone. Gold occurs associated with quartz and pyrite, with the highest gold grades occurring around the intersection of the shear and the granodiorite. Overall, the deposit has an average grade below 2g/t gold.

For Satellite View and Data Sheet Here

Sunrise Dam Gold Mine

|

| Sunrise Dam Gold Mine |

Location: Laverton, Western Australia.

Product: Gold.

Geological Settings: The deposit is hosted by the Archaean Norseman-Wiluna belt, in the Eastern Goldfields Province of the Yilgarn Craton. The deposit falls within the structurally complex Laverton Domain, which is characterized by tight folding and thrusting. A number of other Au deposits lie within or near the margins of the Laverton Domain, including Laverton, Granny Smith (this volume), Red October (this volume), Childe Harold, Lancefield and Keringal. Most of these deposits are hosted by metasedimentary rocks, a distinctive feature of the Laverton region relative to other parts of the Yilgarn Craton.

Host Rocks: The host rocks are shallow-dipping interbedded Archaean metasedimentary, metavolcaniclastic and felsic to intermediate metavolcanic rocks (Newton et al., 1998). The metavolcaniclastic rocks are interbedded with BIF. In general, they are thick, bedded to massive and fine upwards. The BIF units are typically 2-10 m thick and commonly grade into magnetite-rich tuffs. A 20-40 m thick mafic intrusive postdates the metavolcaniclastic sequence on the western side of Cleo. Quartzfeldspar porphyries also intrude the sequence at both Cleo and Sunrise and, at Cleo, post-date the mafic intrusive.

Mineralization: The Sunrise Shear, within the Archaean rocks, controls geometry of the mineralization and is thought to have been the main conduit for Au-bearing hydrothermal fluids (Newton et al., 1998). Pyrite replacement of BIF accounts for most of the primary mineralization and is well developed where the shear zones, parallel to bedding, follow the contact of BIF with less competent units. Gold is also associated with quartzankerite- pyrite veins and pervasive ankerite-silica-sericite-pyrite alteration of intermediate volcaniclastic host rocks. Thin quartz-carbonate veins also host Au, but are mostly located in the Sunrise part of the deposit. Supergene mineralization has developed in the weathered bedrock and in transported cover in the eastern part of the study area.

| ||

|

Yanacocha Gold Mine

|

Yanacocha Gold Mine |

Location: Cajamarca, Peru.

Products: Gold.

It is the largest gold mine in

Latin America, and The second largest gold mine in the world, producing over US$7 billion

worth of gold to date.

Deposit Type: High sulfidation- type epithermal gold deposits.

Geological Settings & Mineralization:

The high-sulfidation epithermal gold deposits are hosted by volcanic rocks that occur at the southern terminus of the northern Peruvian volcanic belt, a continuous sequence of a north-northwest trending Miocene-Pliocene suite of bimodal andesite to rhyolite volcanic rocks that extend into southern Ecuador. In the Yanacocha district, the volcanic pile has been subdivided into three groups: (1) the lower andesite sequence, consisting of an intercalated sequence of block and ash flow tuffs, flow sequences with rare, associated flow domes, and an upper zone dominated by ignimbrites and fine-grained, laminated epiclastic sequences that show a transition into the overlying Yanacocha pyroclastic sequence; (2) the Yanacocha pyroclastic sequence, a variable sequence of lithic to lithic crystal tuffs, extensively altered in the central portion of the district and primary host to the majority of gold deposits within the district; (3) the upper andesite-dacite sequence, consisting of intercalated units of andesite to dacite flows, dominated by multiple flow dome complexes in its upper portion. Ar-Ar age dating within the district has yielded ages ranging from 19 Ma (basal lower andesite) to >12 Ma (upper andesite sequence). The entire volcanic pile has been crosscut by multiple phases of phreatic (vapor phase dominant), phreatomagmatic (intrusive component) and hydrothermal breccias, and intruded by multiple late-stage phases of andesite dikes and dacite to quartz dacite plugs, dikes and stocks (10–8 Ma), the latter of which are associated with shallow Au-Cu porphyry-style mineralization that underlies the high-sulfidation epithermal deposits.

|

| Schematic map showing the geology of western Peru and general location of the Yanacocha mining district. |

Grasberg Gold & Copper Mine

It is the largest gold mine and the third largest copper mine in the world.

|

| Grasberg Gold & Copper Mine |

Location: Papua, Indonesia.

Products: Gold & Copper.

Owner: Freeport-McMoRan.

Deposit Type: Porphyry deposits associated with the 3.2 to 2.7 Ma Grasberg Igneous Complex, porphyry ores of the 4.4 to 3.0 Ma Ertsberg Diorite 2.5 km to the south, and a series of skarns deposits.Together these deposits account for near 80 Mt of copper and around 3900 tonnes of gold (including inferred resources).

Mineralization: Mineralisation associated with the Ertsberg intrusive includes: The Ertsberg stockwork which contained a resource of 122 Mt @ 0.54% Cu, 0.90 g/t Au in 2005.The skarn mineralisation, which includes the: i). GB (Gunung Bijah) - 33 Mt @ 2.5% Cu, 0.8 g/t Au (the original reserve on which mining in the district was commenced), which is surrounded by Ertsberg Diorite near its NW margin; ii). GBT Complex (the vertically stacked GBT, IOZ & DOZ), 1.5 km east of GB on the northern contact, with reserves of >230 Mt @ 1% Cu, 0.8 g/t Au, iii). Dom Skarn, 0.5 km south of GBT, partially enclosed by the intrusive near its SE margin, with >70 Mt @ 1.4% Cu, 0.4 g/t Au, iv). Big Gossan within a fault zone cutting sediments to the west of the Ertsberg Diorite with 33 Mt @ 2.81% Cu, 1 g/t Au, v). Kucing Liar (dated at 3.42 Ma, the oldest mineralisation in the district, predating the Dalam Diorite) is associated with a fault zone between the two intrusive complexes, but close to the Grasberg complex, contains >225 Mt @ 1.42% Cu, 1.57 g/t Au.

|

| Block diagram showing the Grasberg Igneous Complex and zoned alteration. Weak stockwork and potassic alteration associated with South Kali Dikes are not shown. |

Haerwusu Coal Mine

The second biggest coal mine in the world by reserve, and China's largest open-cast coal mine

|

| Haerwusu Coal Mine |

Location: The Inner Mongolia Autonomous Region of China.

Products: Coal.

Owner: China’s state-run Shenhua Group.

Geological settings: The coal-bearing sequences in the Guanbanwusu Coal Mine include the Benxi Formation and the Taiyuan Formation (both Pennsylvanian) and the Shanxi Formation (Lower Permian) with a total thickness of 90–210 m (Fig. 2). Coal reserves of the Guanbanwusu Coal Mine amount to 92.04 Mt (Tehong, 2006).The Benxi Formation, with a thickness of 5.27–42 m, lies unconformably on thevMiddle Ordovician Majiagou Formation, and was deposited in a shallow marinevenvironment. The sediments are mainly composed of bauxite, sandstone, mudstone, and siltstone. The Taiyuan Formation, with a total thickness of 12–115 m, is mainly composed of gray and grayish-white quartzose sandstone, mudstone, siltstone, and coal, interbedded with dark-gray mudstone, siltstone, limestone, and thin-bedded quartzose sandstone. It was formed in paralic delta and tidal flat-barrier complex environments. The No. 6 Coal Seam is located at the uppermost Taiyuan Formation and has a thickness between 12.17 and 17.78 m (average 15 m). There are 9 partings with a cumulative thickness of 2 m in the No. 6 Coal Seam. The Shanxi Formation is composed of mainly of terrigenous coal-bearing clastic rocks dominated by sandstones. The formation has a thickness between 21 and 95 m, with an average of 52 m. It was formed in fluvial and delta deposite environments. The Shanxi Formation has five coal seams (Nos. 1, 2, 3, 4, and 5 Coal Seams), but only Nos. 3 and 5 are locally minable. The strata overlying the coal-bearing sequences are non-coal-bearing Upper Shihezi Formation, Lower Shihezi Formation and Shiqianfeng Formation.

|

| Stratigraphic column of the Guanbanwusu Mine, Jungar Coalfield. |

Al Sukari Gold Mine

Location: Marsa Alam, Red

Sea, Egypt.

Products: Gold.

Owner: Centamin.

Geology of the Sukari gold mine area:

The mine occurs within a Late Neoproterozoic

granitoid (Arslan 1989; Harraz 1991) that intruded older volcanosedimentary successions

and an ophiolitic assemblage, both known as Wadi Ghadir me´lange (El Sharkawi

and El Bayoumi 1979). The volcanosedimentary succession is composed of

andesites, dacites, rhyodacites, tuffs and pyroclastics. Magmatic rocks are of

calc-alkaline affinity (Akaad et al. 1995) and were formed in an island-arc setting

(El Gaby et al. 1990). The dismembered ophiolitic succession is represented by

a serpentinite at the base, followed upwards by a metagabbro-diorite complex and

sheeted dykes. Metagabbro-diorite rocks and serpentinites form lenticular

bodies (1–3 km2) as well as small bodies occur conformably scattered in the

volcanosedimentary arc assemblage (Harraz 1991). All rocks are weakly

metamorphosed (lower greenschist metamorphic facies), intensely sheared and

transformed into various schists along shear zones. Mineralized quartz veins

and talc-carbonate veinlets are common.

The fresh rock is

leucocratic, coarse-grained and pink in color. It has a heterogeneous

mineralogical composition and ranges from monzogranite to granodiorite with dominant

quartz, plagioclase and potash feldspars and less abundant biotite. The Sukari

granitoid has a trondhjemitic affinity (Arslan 1989) and belongs to the ‘‘Younger

Granite Suite’’ of Akaad and Nowier (1980).

Type of Deposit

& Mineralization

How the Gold is Extracted

Thousands of pounds of explosives, trucks and shovels as large as a house, and massive grinding

machines that can reduce hard rocks to dust are involved in the extraction process. In this way, Gold is extracted from one of the largest

open-air mines on the planet. The raw material excavated from the terraces in

the mine contains gold and arsenic in pyrite and arsenopyrite is a distinct

feature of the gold mineralisation at Sukari.

The fresh rock is

leucocratic, coarse-grained and pink in color. It has a heterogeneous

mineralogical composition and ranges from monzogranite to granodiorite with dominant

quartz, plagioclase and potash feldspars and less abundant biotite. The Sukari

granitoid has a trondhjemitic affinity (Arslan 1989) and belongs to the ‘‘Younger

Granite Suite’’ of Akaad and Nowier (1980).

Harraz (1991)

argued for a transitional tectonic environment between within-plate,

volcanic-arc and syncollision granite fields. The age of the Sukari granitoid body

is poorly constrained (630–580 Ma, Harraz 1991) but documents Late Pan-African

magmatic activity in the area.

In the vicinity of

shear zones the granite is foliated, elsewhere, however, it has sharp intrusive

contacts against the older rocks. Along those shear zones serpentinite and

andesite is altered to listvenite rock (Khalaf and Oweiss 1993) that attains up

to 70 m in thickness and extends for several kilometers. At the intersection of

the two shear zones, where the gold mineralization is concentrated, the Sukari

granite is almost completely altered and transected by a large amount of quartz

veins.

Type of Deposit

& Mineralization

The vein-type deposit is hosted in Late Neoproterozoic granite that

intruded island-arc and ophiolite rock assemblages. The vein-forming process is

related to overall late Pan-African shear and extension tectonics. At Sukari,

bulk NE– SW strike-slip deformation was accommodated by a local flower

structure and extensional faults with veins that formed initially at conditions

of about 300 C and 1.5–2 kbar. Gold is associated with sulfides in quartz veins

and in alteration zones. Pyrite and arsenopyrite dominate the sulfide ore

beside minor sphalerite, chalcopyrite and galena. Gold occurs in three distinct

positions: (1) anhedral grains (GI) at the contact between As-rich zones within

the arsenian pyrite; (2) randomly distributed anhedral grains (GII) and along

cracks in arsenian pyrite and arsenopyrite, and (3) large gold grains (GIII)

interstitial to fine-grained pyrite and arsenopyrite.

Fluid inclusion studies yield minimum veinformation temperatures

and pressures between 96 and 188 _C, 210 and 1,890 bar, respectively, which is

in the range of epi- to mesothermal hydrothermal ore deposits. The structural

evolution of the area suggests a longterm, cyclic process of repeated veining

and leaching followed by sealing, initiated by the intrusion of granodiorite.

This cyclic process explains the mineralogical features and is responsible for

the predicted gold reserves of the Sukari deposits. A characteristic feature of

the Sukari gold mineralization is the co-precipitation of gold and arsenic in

pyrite and arsenopyrite.

Kidd Creek Mine It is the world's deepest copper/zinc mine.

Location: Timmins,

Ontario, Canada.

Products: Copper

& Zinc.

Owner: Xstrata Copper.

Deposit Type: The Kidd deposit is one of the

largest volcanogenic massive sulfide ore deposits in the world, and one of the

world's largest base metal deposits.

Ore Geology: Kidd Creek is based on a rich,

steeply dipping volcanogenic sulphide deposit located in the Archaean Abitibi

greenstone belt. There are two major orebodies, with associated smaller lenses.

The ore is hosted in felsic rocks of the Kidd Volcanic Complex and is cut by

mafic sills and dykes. Structural deformation resulting from several phases of

folding and faulting affects the distribution of sulphide lenses.

Three ore types predominate:

massive, banded and bedded (MBB) ores (pyrite, sphalerite, chalcopyrite, galena

and pyrrhotite); breccia ores containing fragments of the MBB ores; and

stringer ores consisting of irregular chalcopyrite stringers cutting a

siliceous volcaniclastic host.

Geological setting & Stratigraphic section of the mine:

The Kidd Creek Volcanic Complex is interpreted to have formed

within a proto-arc geodynamic setting, with the high silica FIII rhyolites a

product of crustal extension during rifting and melting of the lithosphere (Wyman

et al., 1999; Prior et al., 1999). A graben interpreted to contain the Kidd VMS

deposit is consistent with this geodynamic setting and a recent volcanic reconstruction

of the North Rhyolite by DeWolfe et al. (2003), suggest a minimum graben width

of 5 to 7 km (Gibson and Kerr, 1993; Bleeker, 1999). Fissures that controlled

the eruption and emplacement of the Footwall and QP rhyolites may be graben-parallel

structures (Prior, 1996).

The simplified stratigraphic column in Figure 3 provides a general

overview of the Kidd Mine stratigraphy and location of massive sulfide

deposits. Komatiitic flows and intrusions constitute the base of the known stratigraphic

sequence and likely formed a broad, low-relief lava plain upon which the Kidd Creek

rhyolitic dome and ridge complex was constructed. The minimum thickness of the

komatiitic unit is estimated at 500 metres.

| ||

Figure 2. Kidd Mine ore-bodies looking east from surface to 10,200 ft

|

Mining operation and reserves :

The mine started production in 1966

from an open pit. The orebody is now mined at depth through three shafts as the

No.1, No.2 and No.3 Mines. Phase 2 of No.3 Mine is currently being developed.

Mine D will extend Kidd Creek below No 3, from a depth of 2,100m to 3,100m.

Blasthole stoping with cemented

backfill is used to extract the ore underground, Kidd Creek being the world’s

second-largest user of cemented backfill (after Mt Isa in Australia).

Blastholes are drilled using Ingersoll Rand, Mission and Cubex drills and broken

ore is hauled underground by Tamrock load-haul-dump units. The hoisting shafts

are equipped with an ABB Hoist Automation System, which has significantly

increased the efficiency of raising ore from depth.

At the end of 2005, Kidd Creek’s proven and

probable reserves were stated as being 19Mt grading 1.8% copper, 5.5% zinc,

0.18% lead and 53g/t silver. Measured and indicated resources totalled 2.6Mt at

2.2% copper, 6.3% zinc, 0.2% lead and 48 g/t silver, with a further 11.9Mt in

inferred resources at 2.7% copper, 4.8% zinc, 0.3% lead and 81g/t silver.

REFERENCES

Barrie, C.T., 1999. Komatiitic flows of the Kidd Creek footwall,

Abitibi Subprovince, Canada: In Hannington, M.D., and

Barrie, C.T., eds. The Giant Kidd Creek Volcanogenic Massive

Sulfide Deposit, Western Abitibi Subprovince, Canada. Economic

Geology, Monograph 10, p. 143-162.

Beaty, D.W., Taylor, H.P., & Coad, P.R., 1988. An oxygen

isotope study of the Kidd Creek, Ontario, volcanogenic massive

sulfide deposit: Evidence for high heat 18O ore fluid. Economic

Geology, v. 83, p. 1-18.

Bleeker, W., 1999. Structure, stratigraphy, and primary setting

of the late Archean Kidd Creek Volcanogenic massive sulfide

deposit: A semi-quantitative reconstruction: In Hannington,

M.D., and Barrie, C.T., eds.

The Diavik Diamond Mine

|

| Diavik Diamond Mine |

Location: Lac

de Gras, Northwest Territories, Canada.Products: Diamonds.

Owner: Dominion Diamond Corporation and Diavik

Diamond Mines Inc.

Ore Type: The mine consists of three

kimberlite pipes.

Geological notes of Diamond and The

Diavik Mine:

Our knowledge of the primary sources

of diamonds in the lithospheric upper mantle is mainly derived from the studies

of mantle xenoliths in kimberlites and of mineral inclusions in diamonds

themselves. Inclusions in diamonds preserve evidence of the physical and

chemical environment at the time of diamond formation, presumed to have occurred

early in Earth’s history (e.g. Richardson et al. 1984). Mantle xenoliths, in

contrast, integrate a more protracted history that may have involved multiple

stages of melt extraction, and thermal re-equilibration in response to short

lived thermal pulses or secular cooling, and metasomatic re-enrichment. Rare

diamond-bearing peridotite xenoliths provide unique opportunities to study the principal

source of diamonds in the Earth’s mantle directly and to obtain information on

the evolution of cratonic lithosphere, spanning the time from diamond formation

to kimberlite eruption. Based on inclusion studies, peridotitic diamonds

largely formed in depleted harzburgitic sources (Gurney and Switzer 1973; Gurney

1984). Evidence for changes in the composition of peridotitic subcratonic lithospheric

mantle over time, involving a decreasing ratio of harzburgite to lherzolite

(Griffin et al. 2003), raises the possibility that diamonds are stored in

mantle rocks that are compositionally quite distinct from the environment of diamond

formation. This would have important implications for diamond exploration,

because indicator mineral assessment, evaluating the state of mantle

lithosphere at the time of kimberlite eruption, is strongly based on chemical criteria

derived from inclusion studies depicting the environment of diamond formation.

One of the key questions for our study of diamondiferous peridotite xenoliths

from Diavik, therefore, is verifying the extent to which the originally highly

depleted signature at the time of diamond formation has been preserved or

modified during subsequent metasomatic events.

Based on the composition of

xenoliths and garnet xenocrysts, Griffin et al. (1999a) inferred that the mantle

beneath the Lac de Gras area is chemically and thermally stratified. They

suggested that an ‘‘ultradepleted’’, predominantly harzburgitic layer overlies

a less depleted, predominantly lherzolitic layer with the transition being

located at *145 km depth. Griffin et al. (1999a) proposed the shallower

‘‘ultradepleted’’ layer to represent Mesoarchean oceanic or sub-arc mantle

lithosphere and the lower layer to be the frozen head of a Neoarchean plume derived

from the lower mantle. Aulbach et al. (2007) suggested that the deeper portions

of the lower layer experienced secondary re-enrichment in FeO (Aulbach et al.

2007). An alternative model for the formation of subcratonic lithospheric

mantle involves stacking of highly depleted Archean oceanic lithospheric mantle

beneath early continents (e.g. Schulze 1986; Helmstaedt and Schulze 1989;

Bulatov et al. 1991; de Wit 1998; Stachel et al. 1998). In this model, the

observed increase in fertility with depth in the central Slave craton may

relate to metasomatism by infiltrating fluids/melts ascending from the asthenosphere

(Stachel et al. 2003).

References

Aulbach S, Griffin WL, Pearson NJ, O’Reilly SY, Doyle BJ (2007)

Lithosphere formation in the central Slave Craton (Canada):

plume subcretion or lithosphere accretion. Contrib Mineral

Petrol 154:409–427

Bernstein S, Kelemen PB, Hanghøj K (2007) Consistent olivine Mg#

in cratonic mantle reflects Archean mantle melting to the

exhaustion of orthopyroxene. Geology 35:459–462

Bleeker W, Davis WJ (1999) The 1991–1996 NATMAP Slave

province project: introduction. Can J Earth Sci 36:1033–1042

Boyd SR, Kiflawi I, Woods GS (1994) The relationship between

infrared absorption and the A defect concentration in diamond.

Philos Mag B 69:1149–1153

Boyd SR, Kiflawi I, Woods GS (1995) Infrared absorption by the B

nitrogen aggregate in diamond.

Philos Mag B 72:351–361

Griffin WL, Cousens DR, Ryan CG, Sie SH, Suter GF (1998) Ni in

chrome pyrope garnets: a new geothermometer. Contrib Mineral

Petrol 103:199–202

Bingham Canyon (Kennecott) Copper Mine

It is the world's deepest man-made open pit excavation.

%2BCopper%2BMine.jpg) |

| Bingham Canyon (Kennecott) Copper Mine |

Location: Salt

Lake County, Utah, United States.

Products: Copper.

Owner: Rio Tinto Group.

Ore Type : Porphyry copper deposit.

The history of the Mine:

Bingham Canyon was settled in 1848

by the Bingham brothers, Thomas and Sanford, who were ranchers with no mining

experience. In 1863, soldiers stationed at Fort Douglas in Salt Lake City

explored the canyon and discovered lead ore. Utah’s first mining district was

created in the Bingham Canyon area that same year. In 1893, Daniel Jackling, a

metallurgical engineer, and Robert Gemmell, a mining engineer, studied the

deposit and recommended developing the ore body through a revolutionary open-pit

mining method and processing the ore on a large, industrial scale. The miners

and their families lived near Bingham Canyon in places called Highland Boy,

Copper Heights, Copperfield, Carr Fork, Heaston Heights, Telegraph, Dinkeyville,

Terrace Heights, Greek Camp and Frog Town. At one point, the population in the

area approached 20,000 people. In 1903, the Utah Copper Company was formed to

develop the mine, based on the recommendations of Mr. Jackling and Mr. Gemmell.

In 1906, the first steam shovels began mining away the waste rock that covered the

ore body. The ore was found in a part of the mountain that divided the main

canyon.

Geology of the Mine:

Every deposit of ore in the world is

unique. There are no two ore bodies that are alike. Geologic forces were at work

in the Oquirrh Mountains between 260 and 320 million years ago (Late Paleozoic

Period). About 30 to 40 million years ago, molten, metal-bearing rock deep

within the earth’s crust began to push toward the surface and formed Bingham’s

ore deposit. Volcanoes erupted above the evolving ore body. This particular ore

body contains primarily copper, gold, silver and molybdenum.

Tiny grains of ore minerals, mostly

copper and iron sulfides, are scattered within what is called “host rock.”

Because there is far more host rock than there are minerals, it is known as a

low-grade ore deposit. Because this is a low-grade deposit, a ton of ore

contains only about 10.6 pounds of copper. For every ton of ore removed, about

two tons of overburden must first be removed to gain access to the ore.

How big is the Bingham Canyon Mine?

Kennecott Utah Copper’s (KUC)

Bingham Canyon Mine has produced more copper than any mine in history— about

18.1 million tons.

The mine is 2¾ miles across at the

top and ¾ of a mile deep. You could stack two Sears Towers (now known as the

Willis building), on top of each other and still not reach the top of the mine.

The mine is so big it can be seen by space shuttle astronauts as they pass over

the United States. By 2015, the mine will be more than 500 feet deeper than it

is now. If you stretched out all the roads in the open-pit mine— some 500 miles

of roadway — you’d have enough distance to reach from Salt Lake City to Denver.

KUC mines about 55,000,000 tons of copper ore and 120,000,000 tons of overburden

per year.

The mining process:

Bingham Canyon Mine This is where

the mining process begins. Every day, Kennecott Utah Copper mines about 150,000

tons of copper ore and 330,000 tons of overburden. The ore containing copper,

gold, silver and molybdenum is hauled and deposited in the in-pit crusher and

sent to the Copperton Concentrator.

Copperton Concentrator From the

mine, ore is transported on a five-mile conveyor and stockpiled at the

Copperton Concentrator. There the ore is ground into fine particles. The

smaller pieces are then combined with air, water and chemical reagents to

separate the valuable minerals from the waste rock. The mineral bearing

concentrate is then transported to the smelter through a pipeline.

Tailings: Are the leftover rock

material that have had most of the valuable metals removed. Tailings are sent

through a pipeline from the Copperton Concentrator to the tailings impoundment

north of the town of Magna where they are stored.

Smelter: At the smelter, the copper

concentrate is transformed into liquid copper through a flash smelting process.

The copper matte is processed in the furnace to produce 98.6 percent blister

copper. From there, the 720 pound copper plates, called anodes, are sent to the

refinery.

Refinery: At the refinery, anodes are lowered into

electrolytic cells containing a stainless steel blank and acidic solution. For

10 days, an electric current is sent between the anode and the cathode, causing

the copper ions to migrate to the steel sheet. The other impurities, including

gold and silver, fall into the bottom of the cell and are recovered in the

Precious Metals plant. This process forms a plate of 99.99% pure copper. The

copper is separated from the steel sheet and sent to market.

Golden Sunlight Mine

Location: Jefferson County, Montana,

United States.

Products: Gold.

Owner: Barrick Gold Corporation.

Ore Type: Breccia pipe.

Reserves: Golden Sunlight produced

86,000 ounces of gold in 2014 at all in sustaining costs of $1,181 per ounce1.

Proven and probable mineral reserves as at December 31, 2014, were 127,000

ounces of gold2.

In 2015, gold production is expected

to be 90,000-105,000 ounces at all-in sustaining costs of $1,000-$1,025 per

ounce.

Geological setting &

Mineralization

The Golden Sunlight gold-silver

deposit is hosted by a breccia pipe that cuts sedimentary rocks of the Middle

Proterozoic Belt Supergroup and sills of a Late Cretaceous rhyolite porphyry

(Porter and Ripley, 1985; Foster, 1991a, 1991b). At depth, rhyolite porphyry

forms the matrix for fragments of the pipe. Creation of the pipe appears to be

related to emplacement of an underlying hypabyssal stock related to the sills. Crosscutting

the breccia pipe are hydrothermally altered lamprophyre dikes that postdate the

gold-silver ore; locally, these dikes may have created areas of high-grade ore

in the breccia pipe near their margins. The timing of emplacement of various igneous

rocks and the hydrothermal alteration related to mineralization at the deposit.

Gold and silver in the region was

concentrated along northeast-striking, high-angle faults and shear zones, some

of which cut the breccia pipe and along which lamprophyre dikes have been

emplaced (Porter and Ripley, 1985). These structures are thought to be part of

a regional, northeast-striking zone of crustal weakness that has been intermittently

active from the Proterozoic to the present (Foster and Chadwick, 1990; Foster

1991a). Because some hydrothermally altered and mineralized lamprophyre dikes

are preferentially emplaced along structures that cross-cut the breccia pipe,

their relationship to mineralization of the breccia pipe has been ambiguous.

Certainly their emplacement is later than that of the pipe, and the simplest

interpretation is that lamprophyre emplacement postdates mineralization. But,

because the northeast-striking shear zones, veins, and dikes contain high-grade

ore in places, a mineralizing process was obviously continuing during emplacement

of the lamprophyre bodies.

Mine Life

Since its beginnings in 1982, Golden Sunlight

Mine has continued to add resources to extend the life of the mine. Currently,

the Montana DEQ is conducting the environmental review necessary to grant

permission for mining additional resources referred to as the North Area Pit

and South Area Layback, which would extend the mine life into 2016. Additional

exploration is ongoing north of the Mineral Hill pit site with drilling

activity in the Bonnie/Microwave area. 2013 will bring its own mix of success and

challenge, so it is important that we remain intently focused on continuous

improvement. As we work to deliver safe and profitable gold production, we

cannot lose sight of our long-range goals—community partnership, environmental

stewardship and most importantly, the safety and health of our people. I thank

everyone again for the warm reception and look forward to getting to know you

better in the coming months.

Safety and Health

We made great strides in improving our

safety record, an achievement we celebrated in March, when we received Barrick’s

Excellence Award for Best Safety Performance. As of first

quarter 2013, GSM has gone five and a half years, and 2.7 million employee

hours, without a lost-time incident, and over a year without a medical aid

treatment incident. We still have more work to do in order to achieve our goal

of zero incidents. As with most things, safety starts and ends with leadership.

I expect all of our employees to be leaders when it comes to ensuring safety

and continuing to send all GSM employees and contractors home safe and healthy every

day.

Environment

Golden Sunlight Mine was the recipient

of the prestigious Bureau of Land Management (BLM) 2012 Mineral Environmental

Award for our third-party ore processing and reclamation initiatives. Golden

Sunlight Mine initiated the program to assist small miners to mill outside

“ores” and to assist with legacy mine materials containing reasonable

concentrations of precious metals. In presenting the award, the BLM stated:

“The Golden Sunlight Mine has turned liabilities into environmental and

economic benefit—greatly enhancing the quality of the environment, saving

taxpayer dollars, and creating local jobs.”

Lac des Iles Mine

|

| Lac des Iles Palladium Mine |

Location: Toronto,

Canada.

Products: PGE

Deposits.

By product: Gold.

Platinum, silver, nickel, and copper.

Owner: North American

Palladium Ltd.

GEOLOGICAL SETTING AND

MINERALIZATION

The Property is

underlain by mafic to ultramafic rocks of the Lac des Iles Intrusive Complex in

the Wabigoon Subprovince of the Canadian Shield. The LDI-IC is an irregularly-shaped

Neoarchean-age mafic-ultramafic intrusive body having maximum dimensions of

approximately 9 km in the north-south direction and approximately 4 km in the

east-west direction. The complex incorporates three discrete intrusive bodies

viz.:

The North Lac des Iles

Intrusion (NLDI) characterized by a series of relatively flatlying and nested

ultramafic bodies with subordinate mafic rocks.

The Mine Block

Intrusion (MBI), host to all of the stated Lac des Iles mineral reserves and

resources (refer to Sections 14.0 and 15.0).

The South Lac des Iles

Intrusion (SLDI), a predominantly mafic (gabbroic) intrusion having many

similarities to the MBI in terms of rock types and textures. To date, NAP’s

exploration activities have been focused on the MBI. The MBI is a small, teardrop-shaped

mafic complex with maximum dimensions of 3 km by 1.5 km and having an

elongation in an east-northeast direction. The MBI consists of gabbroic (noritic)

rocks having highly-variable plagioclase: pyroxene proportions, textures, and

structures. The MBI was emplaced into predominantly intermediate composition

orthogneiss basement rocks. The MBI is intersected by a series of brittle to

ductile faults and shear zones, some of which appear to control the

distribution of higher-grade palladium mineralization. A major north-trending

shear zone appears to have cut the western end of the MBI and is spatially

associated with the development of high-grade palladium mineralization.

Textural and mineralogical variability is greatest in the outer margins of the

MBI, especially along the well documented western and northern margins that

host most of the known palladium resources. Commonly observed textures in the

noritic marginal units of the MBI include equigranular, fine- to coarse-grained

(seriate textured), porphyritic, pegmatitic, and varitextured. Platinum-group

element and copper-nickel sulphide mineralization in the MBI is found in a

variety of structural and geological settings but in general is characterized

by the presence of small amounts (e.g., typically less than 2%) of fine- to

medium-grained disseminated iron-copper-nickel sulphides within broadly

stratabound zones of platinum group elements (PGE) and gold enrichment.

The

mineralization is commonly associated with varitextured gabbroic rocks;

coarse-grained noritic rocks; and local, intensive zones of amphibolitization,

chloritization and shearing. An important, distinguishing characteristic of the

MBI mineralization relative to other PGE deposits is the consistently high

palladium:platinum ratio, commonly averaging 10:1 or higher. Sulphide mineral assemblages

are dominated by pyrite with lesser pyrrhotite, chalcopyrite, pentlandite, and

millerite.

MINERAL RESERVE ESTIMATE

The mineral reserves were estimated by applying wireframe models depicting stope and pillar shapes to the underground geological block models provided by NAP. NAP aslo provided a separate, more historical geological block model for open pit evaluations, as well as RGO stockpile resource information that was used to estimate the amount of the stockpiled resource material that would be recovered during the LOM time period and accordingly be brought into the reserves. For the underground models, a mineral resource envelope was established with a 1.0 g/t palladium resource grade and a block size of 5 m by 5 m by 5 m. For the open pit block model, NAP used a 2003 block model that had a block size for pit evaluations of 15 m by 15 m by 8 m. Tetra Tech’s senior geologist reviewed and validated each of NAPs submitted block models, prior to use.

|

| Mineral Reserves at the Cut‐off Grades |

Barrick Goldstrike Mine

It is owned and operated by the world's largest gold mining company, & it is the largest gold mine in North America.

|

| The Goldstrike mine |

Location: Eureka County, Nevada, United States.

Products: Gold

, Silver.

Ore Type: Epithermal gold deposite in carbonate or silicate sedimentary rocks.

Owner: Barrick Gold.

Ounces of

gold produced in 2014 >> 902,000

Ounces of

proven and probable gold reserves >> 9,614,000

Overview: The Goldstrike mine,

one of the top five gold-producing mines in the world, is Barrick Gold’s

largest producing mine. The mine consists of both the Betze-Post open-pit and

the Meikle and Rodeo underground mines (the “Goldstrike Mine”). Barrick, which

is also the biggest gold producer in the world, has operated the mine for over

20 years (since 1987). The mine is located on the Carlin Trend in north-central

Nevada, USA, about 40 kilometers northwest of the city of Elko. In 2007, the

Goldstrike operation produced 1.63 million ounces of gold at average total cash

costs of $373 per ounce. The Goldstrike property comprises approximately 4,197 hectares

of surface rights ownership and approximately 3,535 hectares of mineral rights

ownership on the Carlin Trend, a prolific gold producing region of North

America. The northwestsoutheast trend is an 80 km long, 8 km wide belt that contains

more than 20 major gold deposits. The operation employs approximately 1,600

employees.

Geological settings & Mineralization : The Goldstrike mine

complex (including the Betze-Post-Screamer and Meikle Rodeo deposits).

Betze-Post Open Pit

After Barrick took

over the operation, two sulphide ore zones were identified as the Betze and

Deep Post deposits in 1987. Since it entered production in 1993, the Betze-Post

pit has been a truck-and-shovel operation using large electric shovels. The

Betze-Post ore zones extend for 1,829 meters northwest and average 183 to 244

meters in width and 122 to 183 meters in thickness. The Post oxide orebody

occurs in the siliceous siltstones, mudstones, argillites and minor limestones

of the Rodeo Creek Formation. The Betze and Post oxide deposits are hosted in

sedimentary rocks of Silurian to Devonian age. The mineralization of the Betze-Post

pit was captured by structural traps developed by Mesozoic folding and thrust

faults. Volcanic and sedimentary rocks filled ranges and basins formed by

Tertiary faulting. The Tertiary volcanism initialized gold mineralization

approximately 39 million years ago.

In 2007, the open pit

mine produced 1,215,000 ounces of gold from 136.9 million tons mined and 10.5

million tons processed. The average grade processed is 0.136 oz/ton with a

recovery rate of 85.5%. The average total cash cost was $355 per ounce. The

open pit mine has proven and probable reserves totaling 12.19 million ounces

from 94.9 million tons grading 0.128 oz/ton. The mine is expected to sustain

the current production level for approximately 8 years, based on existing

reserves. Most of the open pit mine is subject to a net smelter return of up to 4% and a net profits interest of up to 6%.

Meikle Rodeo deposits

The Meikle deposit

occurs in hydrothermal and solution collapse breccias in the Bootstrap

Limestone of the Roberts Mountains Formation. The gold at Goldstrike was

carried into the various orebodies by hot hydrothermal fluids, and deposited with

very fine pyrite and silica. Over time, the pyrite oxidized, freeing the gold

and making its extraction relatively easy, as in the Post Oxide deposit. In the

deeper deposits – Betze, Rodeo and Meikle – the gold is still locked up with

the iron sulphide and an additional processing step (autoclaving or roasting)

is required to free the gold. Two haulage drifts connect the Meikle and Rodeo

orebodies.

The drifts are

accessed from two shafts and by a decline at the bottom of the open pit mine. In

the year ended December 31, 2007, the underground mine produced 413,186 ounces

of gold at an average total cash cost of $431 per ounce. Proven and probable

reserves underground are estimated at 7.42 million tons at 0.364 oz/ton, containing

2.7 million ounces. The Goldstrike’s total (open pit and underground) proven

and probable mineral reserves as of December 31, 2007 are estimated at 14.9

million ounces of gold. The underground mine, which originally produced at a

rate of approximately 2,000 tons of ore per day, averaged 3,562 tons per day in

2007. Based on current reserves and production capacity, the expected mine life

is 9 years. The maximum royalties payable on the Meikle deposit are a 4% net smelter return and a 5%

net profits interest.

Mining Processing & operations: The Goldstrike complex

consist of three distinct mines: the large Betze-Post open pit mine, and the

Meikle and Rodeo underground mines. The ore from all three mines is milled and

leached by the cyanide process. Carlin-type gold deposits host gold mainly as

microscopically fine grains. Refractory non-carbonaceous sulphide ore is

treated in an autoclave followed by a carbon-in-leach (CIL) cyanidation

circuit. Carbonaceous ore, also refractory, is treated with a roaster followed

by a CIL circuit. The two treatment facilities treat ores from both the open

pit and underground mines. Recovered gold is processed into doré on-site and

shipped to outside refineries for processing into gold bullion.

In 2008 the Betze-Post

open-pit mine produced 1,281,450 oz (36,328 kg) of gold and 152,886 oz (4,334.2

kg) of silver, while the Meikle-Rodeo underground operations yielded 424,687 oz

(12,039.7 kg) of gold and 51,438 oz (1,458.2 kg) of silver. This was 30% of the

total 5,698,000 oz (161,500 kg) output of all gold mining operations in Nevada.

Non-carbonaceous

sulphide (refractory) ore is treated at an autoclave and carbon-in-leach (CIL)

cyanidization circuit. Carbonaceous ore is treated at the roaster and CIL

circuit, since the active carbon content in carbonaceous ore responds poorly to

autoclaving. The two facilities treat ores from both the open pit and

underground mines and, when combined, have a design capacity of 33,000 to

35,000 tons per day. Recovered gold is processed into doré on-site and shipped

to outside refineries for processing into gold bullion. A modified pressure

leach technology was successfully tested last year and it will be used to process

ores that would otherwise have been treated at the roaster facility,

consequently extending the life of the autoclave. The property also has a 115

megawatt natural gas-fired power plant, providing a significant portion of the

operation’s power requirements off-grid.

The Ranger Uranium Mine

|

| The Ranger Uranium Mine |

Location: Kakadu

National Park, Northern Territory, Australia.

Products: Uranium.

Owner: Energy Resources of Australia

Limited.

Deposit Type: Unconformity-related uranium deposits.

Overview: In 1969 the Ranger

orebody was discovered by a Joint Venture of Peko Wallsend Operations Ltd (Peko)

and The Electrolytic Zinc Company of Australia Limited (EZ). In 1974 an

agreement set up a joint venture consisting of Peko, EZ and the Australian

Atomic Energy Commission (AAEC).

In 1978, following a

wide ranging public inquiry (the Ranger Uranium Environmental Inquiry) and

publication of its two reports (the Fox reports), agreement to mine was reached

between the Commonwealth Government and the Northern Land Council, acting on

behalf of the traditional Aboriginal land owners. The terms of the joint

venture were then finalised and Ranger Uranium Mines Pty Ltd was appointed as

manager of the project.

In August 1979 the

Commonwealth Government announced its intention to sell its interest in the

Ranger project. As a result of this, Energy Resources of Australia Ltd (ERA)

was set up with 25% equity holding by overseas customers. In establishing the

company in 1980 the AAEC interest was bought out for $125 million (plus project

costs) and Peko and EZ became the major shareholders. Several customers held 25%

of the equity in non-tradable shares. Ranger Uranium Mines Pty Ltd became a

subsidiary of ERA. During 1987-8 EZ's interest in ERA was taken over by North

Broken Hill Holdings Ltd and that company merged with Peko. Consequently ERA

became a 68% subsidiary of North Limited, and this holding was taken over by

Rio Tinto Ltd in 2000. In 1998 Cameco took over Uranerz, eventually giving it

6.69% of ERA, and Cogema took over other customer shares, giving it (now Areva)

7.76%.

Late in 2005 there was

a rearrangement of ERA shares which meant that Cameco, Cogema and a holding

company (JAURD) representing Japanese utilities lost their special unlisted

status and their shares became tradable. The three companies then sold their

shares, raising the level of public shareholding to 31.61%.

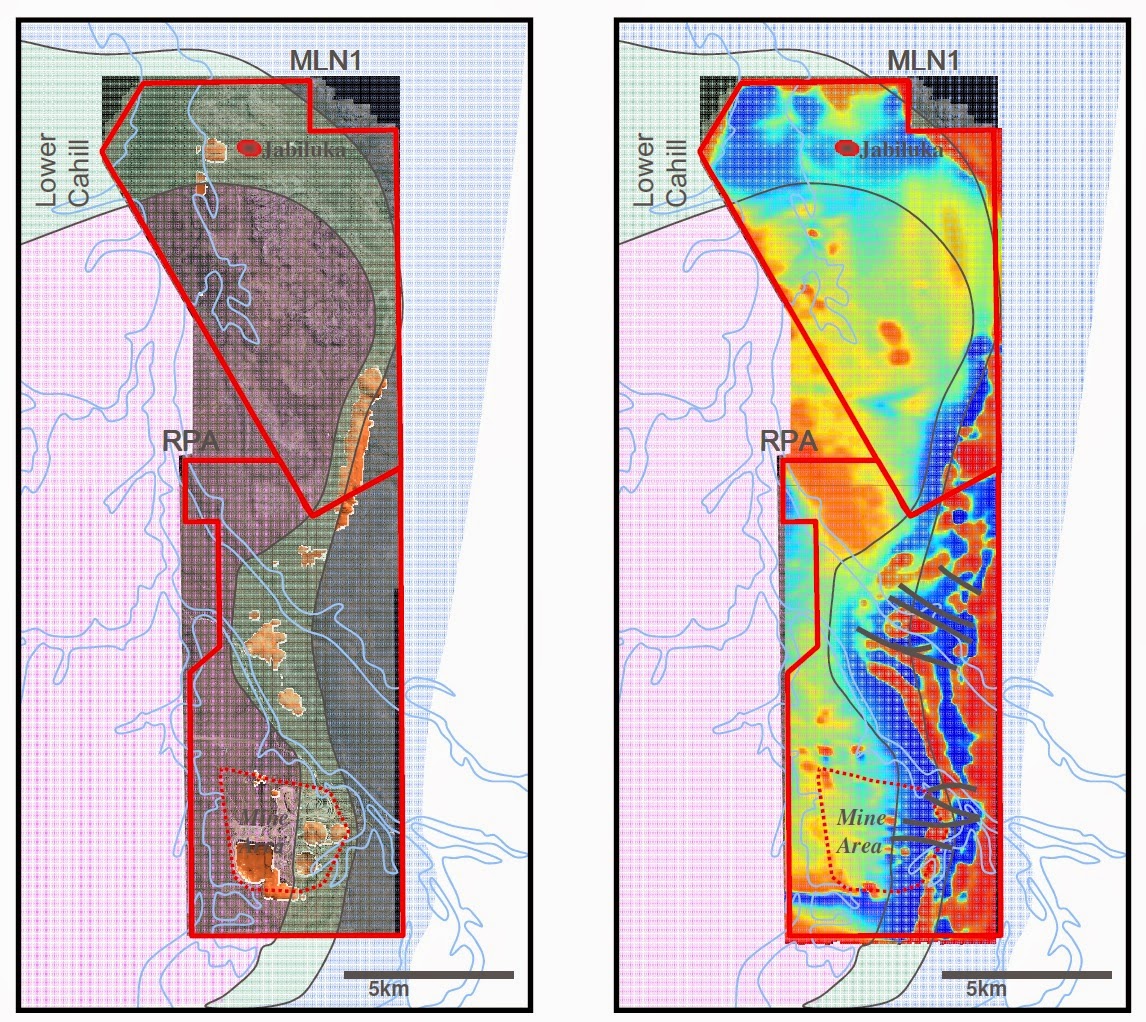

Geological Features:

Features associated with some of the

unconformity-related uranium deposits in the Alligator Rivers, Rum Jungle and

South Alligator Valley uranium fields are as follows (modified after Ewers

& others, 1984; Mernagh, Wyborn & Jagodzinski, 1998): The host rocks

occur in intracontinental or continental margin basins; the deposits are near

to a late Palaeoproterozoic oxidised thick cover sequence (>1 km) of quartz-rich

sandstone;

The basement is chemically reduced,

containing carbonaceous/ferrous iron-rich units or feldspar-bearing rocks;

The deposits are associated with a

Palaeoproterozoic/late Palaeoproterozoic unconformity and with dilatant brecciated

fault structures, which cut both the cover and basement sequences and separate

reduced lithologies from the oxidised cover sequence;

Most of the large deposits in the

Alligator Rivers and the Rum Jungle fields are in stratabound ore zones and

have a regional association with carbonate rock/pelitic rock contact, but an

antipathetic relationship with carbonate in the ore zones;

The major Australian deposits lie

close to an unconformity although the Jabiluka deposit is still open some 550 m

below the unconformity;

The known major uranium deposits are

present where the oxidised cover sequence is in direct contact with the

reducing environments in the underlying pre-1870 Ma Archaean–Palaeoproterozoic

basement and not separated by an intervening sequence, as by the El Sherana and

Edith River Groups in the South Alligator Valley uranium field.

| |

|

|

| Local stratigraphy of The Ranger Mine |

Alteration

Alteration features associated with

the deposits are:

Alteration extends over 1 km from the

deposits,

Alteration is characterised by

sericite–chlorite ± kaolinite ± hematite,

Mg metasomatism and the formation of

late-stage Mg rich chlorite are common,

Strong

desilicification occurs at the unconformity.

| |

|

Source of Uranium mineralization

Archaean and

Palaeoproterozoic granites of the Alligator Rivers and South Alligator Valley

uranium fields have uranium contents which are well above the crustal average

of 2.8 ppm U (Wyborn, 1990a). Granites and granitic gneisses of the Nanambu

complex contain 3–50 ppm U; tonalites, granitic gneisses and granitic migmatites

of the Nimbuwah complex have 1–10 ppm U. The Nabarlek Granite that has been

intersected in drill holes below the Nabarlek deposit has 3–30 ppm U, and the

Tin Camp and Jim Jim Granites also have high uranium contents. The Malone Creek

Granite (South Alligator Valley) has 11–28 ppm U. Wyborn (1990b) suggested that

the underlying crust in the region of these uranium fields is enriched in

uranium. Maas (1989) concluded from Nd–Sr isotopic studies that for Jabiluka,

Nabarlek and Koongarra, the uranium was derived from two sources: the

Palaeoproterozoic metasediments and a post-unconformity source, probably highly

altered volcanics within the Kombolgie Subgroup. Maas (1989) also proposed that

these orebodies formed when hot oxidising meteoric waters, which contained

uranium derived from volcano-sedimentary units within the Kombolgie, reacted

with reducing metasediments of the Palaeoproterozoic basement.

|

| Uranium mineralization |

Processing: Following crushing,

the ore is ground and processed through a sulfuric acid leach to recover the

uranium. The pregnant liquor is then separated from the barren tailings and in

the solvent extraction plant the uranium is removed using kerosene with an

amine as a solvent. The solvent is then stripped, using an ammonium sulphate

solution and injected gaseous ammonia. Yellow ammonium diuranate is then

precipitated from the loaded strip solution by raising the pH (increasing the

alkalinity), and removed by centrifuge. In a furnace the diuranate is converted

to uranium oxide product (U3O8).

Reserves & Resources: The Ranger 1 orebody,

which was mined out in December 1995, started off with 17 million tonnes of ore

some of which is still stockpiled. The Ranger 3 nearby is slightly larger, and

open pit mining of it took place over 1997 to 2012.

In 1991 ERA bought

from Pancontinental Mining Ltd the richer Jabiluka orebody (briefly known as

North Ranger), 20 km to the north of the processing plant and with a lease

adjoining the Ranger lease. ERA was proposing initially to produce 1000 t/yr

from Jabiluka concurrently with Ranger 3. The preferred option involved

trucking the Jabiluka ore to the existing Ranger mill, rather than setting up a

new plant, tailings and waste water system to treat it on site as envisaged in

an original EIS approved in 1979. However, all these plans are now superseded –

see Australia's Uranium Deposits and Prospective Mines paper.

In the Ranger 3 Pit

and Deeps the upper mine sequence consists of quartz-chlorite schists and the

lower mine sequence is similar but with variable carbonate (dolomite, magnesite

and calcite). The primary ore minerals have a fairly uniform uranium mineralogy

with around 60% coffinite, 35% uraninite and 5% brannerite. In weathered and

lateritic ores the dominant uranium mineralogy is the secondary mineral

saleeite with lesser sklodowskite.

In the second half of

2008 a $44 million processing plant was commissioned to treat 1.6 million

tonnes of stockpiled lateritic ore with too high a clay content to be used

without this pre-treatment. Following initial treatment the treated ore is fed

into the main plant, contributing 400 t/yr U3O8 production for seven years. A

new $19 million radiometric ore sorter was commissioned at the same time, to

upgrade low-grade ore and bring it to sufficient head grade to go through the

mill. It will add about 1100 tonnes U3O8 to production over the life of the

mine, and be essential for beneficiating carbonate ore from the lower mines

sequence of the Ranger 3 Deeps.

A feasibility study

into a major heap leach operation for 10 Mt/yr of low-grade ore showed the

prospect of recovering up to 20,000 t U3O8 in total. Column leach trials were

encouraging, yielding extractions of greater than 70% at low rates of acid

consumption. The facility would consist of fully lined heaps of material about

5m high and covering about 60-70 ha. These will be built and removed on a

regular cycle and the residues stored appropriately after leaching is

completed. The acid leach solutions would be treated in a process similar to

that used in the existing Ranger plant and recycled after the uranium is

removed from the pregnant liquor. ERA applied for government (including

environmental) approval for the project, which was expected to begin operation

in 2014, but in August 2011 ERA announced that the plan was shelved due to high

capital costs and uncertain stakeholder support. As a result, ore reserves of

7,100 tonnes of uranium oxide were reclassified as resources.

In 2006 the projected operating life of the

Ranger plant was extended to 2020 due to an improvement in the market price

enabling treatment of lower grade ores, and in 2007 a decision to extend the

operating Ranger 3 open pit at a cost of $57 million meant that mining there

continued to 2012. However, reassessment of the low-grade stockpile in 2011

resulted in downgrading reserves by 6100 t U3O8. The #3 pit is now being

backfilled, and to mid-2014, 31 million tonnes of waste material had been moved

there. It will then be used as a tailings dam.

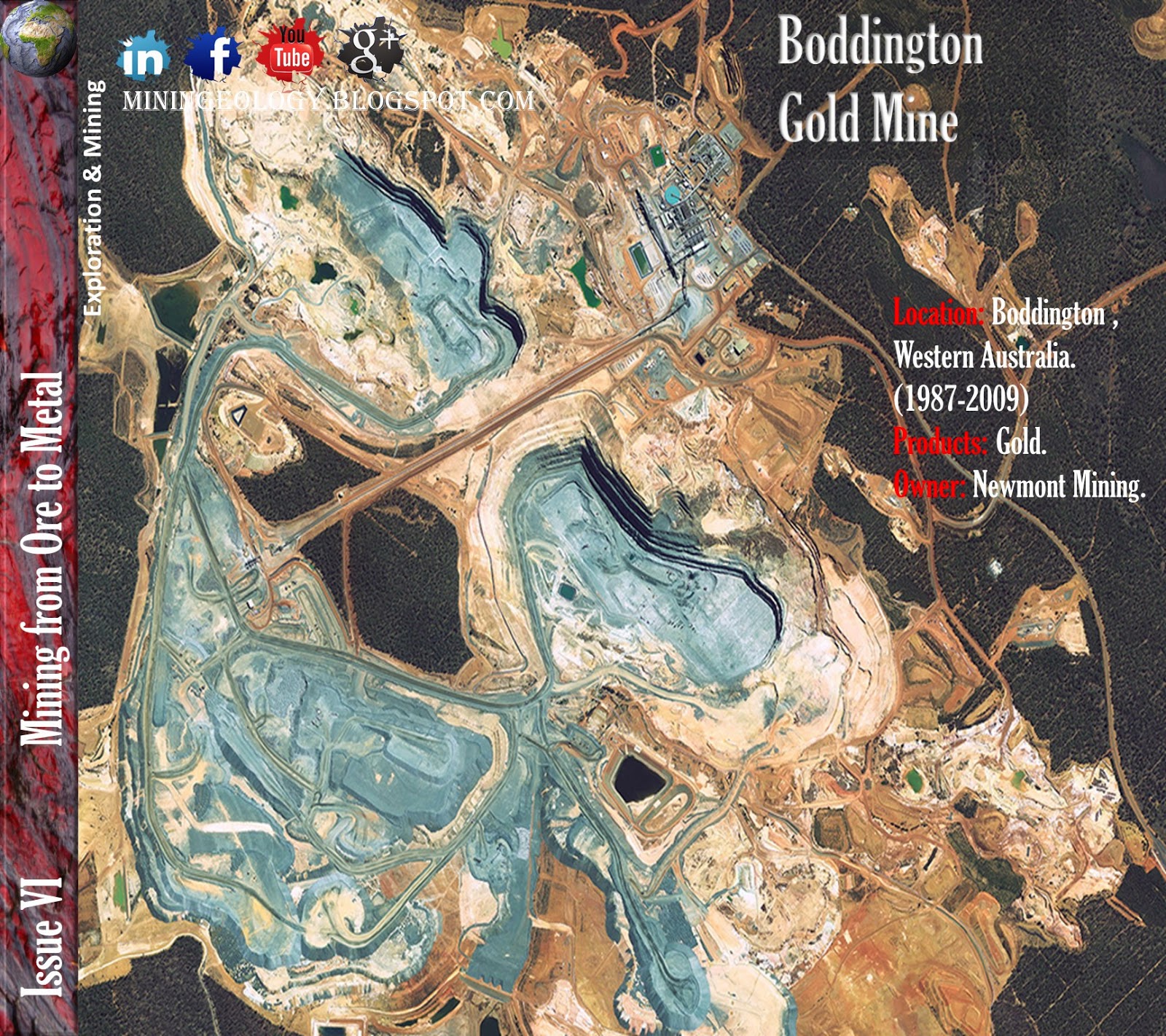

Boddington Gold Mine

|

| Boddington Gold Mine |

Location: Boddington ,Western

Australia.

Ore Type: Lode Deposits.

Products: Gold. Secondary Copper.

Owner: Newmont Mining.

Reserves: By the end of 2011,

proven ore reserves at Boddington were 20.3 million ounce (moz) of gold and

2.26 billion pounds (blbs) of copper.

Overview: Boddington Gold Mine

(BGM) is located about 130km south-east of Perth in Western Australia. The

largest gold mine in the country, it is poised to become the highest producing

mine once production ramps up over the next few years. The $2.4bn project was

initially a three-way joint venture between Newmont Mining, AngloGold Ashanti

and Newcrest Mining. In 2006 Newmont bought Newcrest's 22.22% share, bringing

its interest to 66.67% and ending any Australian ownership. AngloGold owned the

remaining 33.33%. In June 2009, Newmont became the sole owner of the mine by

acquiring the 33.3% interest of AngloGold. The original, mainly oxide open-pit

mine was closed at the end of 2001.

The project has an

attributable capital budget of between A$0.8bn and A$0.9bn. On 23 July 2009,

the project, including the construction of the treatment plant, was completed.

Production began in the third quarter of 2009. The first gold and copper concentrate

was produced in August 2009.

Approximately 100,000t

of ore was processed by mid-August. Gold production began on 30 September 2009.

By 19 November 2009, the mine achieved commercial production. The mine was

officially inaugurated in February 2010. The project had an attributable

capital budget of between A$0.8bn and A$0.9bn. It employs 900 workers.

Based on the current

plan, mine life is estimated to be more than 20 years, with attributable

life-of-mine gold production expected to be greater than 5.7Moz.

In May 2012, Newmont

decided to seek the expansion of mine life to 2052 by combining the north and

south Wandoo open pits. It also plans to expand the waste rock facility to two

billion metric tons.

Newmont and Anglo had

focused their exploration activities on the poorly explored areas of the

greenstone belt outside the already identified Boddington Expansion resource.

The exploration strategy was to identify the resource potential of the

remainder of the greenstone belt, with the emphasis on high-grade lode-type deposits.

Geological settings & Mineralization:

The Boddington gold

mine is hosted in Archean volcanic, volcaniclastic, and shallow-level intrusive

rocks that form the northern part of the Saddleback greenstone belt, a

fault-bounded sliver of greenstones located in the southwestern corner of the

Yilgarn craton, Western Australia. Total Au content of the Boddington gold mine

(past production plus in situ resource) exceeds 400 metric tons, making the

Boddington gold mine one of the largest Au mines currently operating in

Australia.Geologic mapping and radiometric dating indicate that five phases of

igneous activity occurred during development of the Saddleback greenstone belt.

Basaltic, intermediate, and minor felsic volcanism occurred between

approximately 2714 and 2696 Ma and again at approximately 2675 Ma. An older

suite of ultramafic dikes was emplaced between approximately 2696 and 2675 Ma

and a younger suite was emplaced between approximately 2675 and 2611 Ma.

Granitoid plutons crystallized at approximately 2611 Ma and cut all the other

Archean rocks in the Saddleback greenstone belt.Regional upper greenschist

facies metamorphism accompanied the earliest phase of ductile deformation (D 1

). Sericite-quartz + or - arsenopyrite-altered shear zones developed during

subsequent ductile deformation (D 2 ). Crosscutting relationships indicate that

D 1 and D 2 predate approximately 2675 Ma. Further ductile shear zones

characterized by quartz-albite-sericite + or - pyrite alteration developed

during D 3 , after approximately 2675 Ma. Narrow brittle faults (D 4 ) with

biotite + or - clinozoisite alteration halos, active between approximately 2675

and 2611 Ma, cut the three generations of ductile shear zones.Rare

quartz-albite-fluorite-molybdenite + or - chalcopyrite + or - pyrrhotite veins

developed prior to D 1 and the regional metamorphism. These veins are not

associated with any Au mineralization or significant Cu. Quartz + or - pyrite +

or - molybdenite + or - Au veins and crosscutting clinozoisite-biotite + or -

actinolite + or - quartz-chalcopyrite-pyrrhotite + or - galena + or -

molybdenite + or - scheelite Au veins developed during movement on the D 4

faults between approximately 2675 and 2611 Ma. Mineralized veins crosscut the

three generations of ductile shear zones but are not foliated. Movement on the

D 4 faults controlled the location of mineralization within the Boddington gold

mine. Higher grade mineralization occurs along the D 4 faults and coplanar

pyroxenite dikes and where the faults intersect older shear zones, and quartz

veins. Widespread lower grade stockwork mineralization is concentrated in the

general vicinity of the D 4 faults. The orientation of veins within stockworks

is consistent with vein development during sinistral strike-slip movement on

the D 4 faults. Au-Cu + or - Mo + or - W mineralization at the Boddington gold

mine, therefore, occurred late in the tectonic evolution of the Saddleback

greenstone belt.The timing of mineralization at the Boddington gold mine is

analogous to many other structurally late Au deposits in the Yilgarn craton,

e.g., Mount Magnet, Mount Charlotte, and Wiluna. Movement on the D 4 faults and

mineralization may have been coeval with the emplacement of granitoid

intrusions at approximately 2611 Ma. Whereas these granitoids are unaltered and

therefore unlikely to have been the source of significant volumes of

hydrothermal fluids, they may have provided the thermal energy necessary to

drive circulation of auriferous hydrothermal fluids through D 4 faults that may

also have accommodated their intrusion.Previous workers at the Boddington gold

mine have inferred that mineralization is genetically linked to subvolcanic

intrusions emplaced between approximately 2714 and 2696 Ma. However, this

inference is inconsistent with the crosscutting relationships of structures and

mineralized veins which indicate that mineralization occurred between

approximately 30 and 80 Ma after emplacement of these rocks.

|

| General Geological Map of Boddington Gold Mine |

Batu Hijau Gold Mine

|

| Batu Hijau Gold Mine |

Location: Sumbawa,

West Nusa Tenggara, Indonesia.

Products: Copper

& Gold.

Owner: P.T.

Newmont Nusa Tenggara.

Ore Type: Porphory Copper deposits.

Reserves: the Batu Hijau included 2.77 million tonnes of copper with an average grade of 0.69g/t gold, which would allow mining to continue until 2025.

Ore geology and Mineralization: The Batu Hijau

porphyry Cu‐Au deposit is a world‐class island arc type porphyry deposit,

located on the southwestern portion of Sumbawa Island, Nusa Tenggara Barat

Province, Indonesia. This 12 km by 6 km district contains an estimated 914

million tonnes of ore at an average grade of 0.53% Cu and 0.40 g/t Au (Garwin,

2002; Arif and Baker, 2004), and is one of the largest and richest porphyry Cu‐Au

deposits in Asia.

Ore fluids produced

distinct quartz ± sulfide veins and veinlets that cross cut the tonalite

intrusions and their surrounding host rocks. Within these veins, fluid inclusions

trapped in quartz contain ore fluids, which represent fluids moving through the

deposit during the time of its formation. The ore fluids in the fluid inclusions

are key to defining the temperature and pressure conditions under which the

deposit formed, and defining the geochemistry of the hydrothermal system, which

was responsible for the distribution Cu and Au within the deposit.

Preliminary fluid

inclusion studies have suggested that deposit formation temperatures ranged

from 280 to over 700 °C. Based on the coexistence of magnetite‐bornite ,chalcocite,

Garwin (2000) suggested that the earliest veins at Batu Hijau likely formed at

> 500–700 °C (cf. Simon et al., 2000). A preliminary fluid inclusion study

by Garwin (2000) on inclusions in halite‐bearing transitional veins produced

homogenization temperatures that ranged from about 450 to 500 °C. These

temperatures are consistent with phase equilibria temperature estimates based on a chalcopyrite , bornite

vein mineralogy (Simon et al., 2000).

Homogenization

temperatures of < 400 °C were obtained by Garwin (2000) for late pyrite‐bearing

veins. A fluid inclusion study conducted by Imai and Ohno (2005) documented

homogenization temperatures ranging from 280 to 454 °C, significantly lower

than temperatures obtained by Garwin (2000). This temperature is similar to Au

saturation temperatures for bornite (~300 °C) and chalcopyrite (250 °C) (Kesler

et al., 2002; Arif & Baker, 2004).

A detailed fluid

inclusion microthermometry study to clarify processes of ore formation is

warranted. Microthermometric data on well‐characterized fluid inclusions with

appropriate pressure corrections can provide the temperatures and pressures at

which the deposit formed. Additional qualitative and quantitative data from

synchrotron x‐ray fluorescence (SXRF) and laser ablation inductively coupled plasma

mass spectrometry (LA‐ICP‐MS), respectively, can document and quantify major

and trace element concentrations. Such data will contribute to a model describing

the transport of metals by hydrothermal fluids, and the precipitation of Cu‐

and Au‐bearing minerals.

Mining & Milling: Batu Hijau is an

open-pit mine. Ore is removed from the mining face using P&H 4100 electric

shovels (pictured) and loaded into Caterpillar 793C haul trucks. Each haul

truck can move a payload 220 t (240 short tons) of ore. The trucks haul ore

from the shovel to primary crushers. Crushed ore is sent by a conveyor 1.8 m (6

ft) wide and 6.8 km (4.2 mi) long to the mill. Daily production from the mine

is an average of 600,000 t (660,000 short tons) ore and waste combined. Ore

from the mine has an average copper grade of 0.49% and an average gold grade of

0.39g/t.

Crushed ore is further

reduced in size by Semi-Autogenous Grinding and ball mills. Once milled it is

sent through a flotation circuit which produces a concentrate with a grade of

32% copper and 19.9g/t gold. The mill realizes a copper recovery of 89%.[3] The

concentrate is thickened into slurry and piped 17.6 km (10.9 mi) to the port at

Benete where water is removed from the slurry. The concentrate storage at the

port can hold 80,000 t (88,000 short tons) of copper-gold concentrate.

The Herradura Gold Mine

|

| La Herradura Gold Mine . |

Location: Sonora,

Puerto Penasco, Mexico (MX).

Products: Gold.

Owner: Fresnillo plc.

Average ore grade in reserves: 0.80 g/t Gold

Total Reserves: 1.5 Moz Gold

Mine Life: 4.1 years

MINING AND EXPLORATION HISTORY

The La Herradura mine

contains 5.4 million ounces of contained gold in production plus reserves. The

deposit is owned by Minera Penmont, a Joint Venture between Peñoles and

Newmont. As a result of an aggressive grassroot exploration program in

northwestern Mexico that started in 1987, the first economic drill intersection

in La Herradura came in 1991 (100m @ 0.85 g/t Au). Subsequent and continuous

drilling campaigns resulted in the definition of an orebody containing 1.7 M oz

by May 1998, when mine operations started. To date, 2 M oz of gold have been

produced. Present reserves are 3.4 M oz of gold in ore with an average grade of

1 g/t, using a cut-off of 0.35 g/t Au. The mine produces 210,000 ounces of gold

per year ( Jose de la Torre, pers. commun., 2008).

Regional Geologic and Tectonic

Setting

La Herradura mine is

located in northwestern Sonora, Mexico. This deposit occurs within a northwest

trending belt that consists of metamorphic rocks of greenschist and amphibolite

facies and granitoids of Proterozoic age (Nourse et al., 2005). These rocks are

intruded by a series of Triassic and Middle Jurassic granitoids and are

overlain by younger sedimentary and volcanic rocks of Middle to Late Jurassic

age (Figure 2.1). All these units are intruded by Late Cretaceous to early

Tertiary granitoids related to the Laramide orogeny and are overlain by Miocene

rhyolites, andesites, and basalts and Quaternary basalts. Basin and Range

tectonics affect this area, as they do much of Sonora and adjacent Arizona.

Basin and Range faulting occurred in the mid to late Tertiary. Faulting

resulted in the formation of NW-trending linear ranges of crystalline rock,

separated by deep basins filled with sand and gravel derived from the ranges. Correlation is difficult between ranges.

The Geologic Setting of La Herradura

La Herradura mine

occurs within a northwest trending belt of Proterozoic rocks consisting of

greenschist and amphibolite grade metamorphic rocks and granitoids. The deposit

is hosted in biotite-quartz-feldspar and quartz-feldspathic gneisses that are

bordered to the east by Jurassic clastic rocks and subvolcanic intrusions and

to the west by upper Paleozoic limestone. Isolated outcrops of fresh andesite,

trachyte, and basalt occur locally northeast of the mine.

The Structural Setting

of La Herradura

Based on structural

mapping in the La Herradura mine area, it is possible to identify at least five

tectonics events superimposed on all stratigraphic units outcropping in this

area (de la Torre, 2004; Romero 2005, Table 2.1). These observations indicate

that gold mineralization is associated with the third tectonic event, and they

also tend to constrain the age of this mineralization to between 80 and 45 Ma.

Alteration of La

Herradura

Reported alterations assemblages of this deposit

(de la Torre, 2004; Romero, 2005) are quartz-sericite-albite in the core of the

deposit and selectively follow the quartz-feldspar gneiss bands in the outer

zones of the deposit. Iron-carbonates (ankerite-siderite) are widespread within

the deposit, mainly restricted to haloes adjacent to quartz-sulfide veins

within the core of the orebody. Iron carbonates also are found in the outer

alteration aureoles of the deposits. Propylitic alteration islocated in the

outermost portions of the deposit, and it occurs mainly in the biotite-bearing

gneiss and in Jurassic rhyolitic and andesitic volcanic rocks.

Andacollo Mine

|

| Andacollo Mine |

Location: Elqui,

Coquimbo, Chile.

Products: Copper

& Gold.

Owner: Royal Gold,Inc.

Ore Type: Porphyry copper-gold

deposit, hosted by altered andesitic and dacitic volcanic rocks, and small

stocks and irregular dykes of potassium-rich tonalitic porphyry.

Overview

The Andacollo mining district is

located in the Coquimbo region of Chile at 30°14’ south, 71°06’ west, some 55

km southeast of La Serena, at a mean elevation of 1030 m within a semi-arid

hilly landscape. Current mining activity in the district is concentrated on

copper and gold. These metals are mined, respectively, from a porphyry copper deposit

and epithermal, manto and vein gold deposits of adularia–sericite type.11,13

Other types of mineralization include mercury veins hosted by carbonate rocks.

The gold veins are controlled by a northwest-trending set of normal faults, whereas

the manto-type mineralization is strata-bound and largely confined to andesite

breccias, dacites and sites of strong fracturing. The lateral and vertical

continuity of the mantos is strongly controlled by rock type, faulting and

intensity of fracturing. The gold deposits have been the focus of a recent

study,11 but comparable information on the Andacollo porphyry has not become

available.

Andacollo’s operating profit from August

22 to December 31, 2007 was $27 million before the effects of the revaluation

of copper inventory to fair value on acquisition and negative pricing adjustments.

The revaluation established a higher value for copper inventories, based on

market prices at the date of acquisition. This increased our cost of sales by

$24 million and the subsequent decline in metal prices resulted in a loss on

the sale of these inventories. In addition, the mine recorded negative pricing

adjustments of $2 million since they acquired it in August 2007. After these adjustments,

Andacollo’s operating profit was $1 million. Copper cathode production in 2008

is expected to be approximately 20,000 tonnes and capital expenditures are

planned at US$190 million, including US$185 million on the hypogene

development.

Geological setting and

Mineralization

The Andacollo deposits are the products of a complex hydrothermal system

and consist of a porphyry copper-gold deposit and peripheral strata-bound manto

gold deposits and veins with minor associated base metals. The hydrothermal

system was part of the Pacific porphyry copper belt which was generated during

development of an Early Cretaceous magmatic arc displaying shoshonitic

petrochemical affiliations. Rocks that crop out in the area include a volcanic

sequence, the Arqueros and Quebrada Marquesa Formations, consisting of andesitc

and dacite flows, volcanic breccias, and pyroclastic rocks of Early Cretaceous

age. Intrusive rocks range from diorite to granodiorite in composition and date

between 87 and 130 Ma. The porphyry copper-gold deposit is zoned vertically

downward from a leached capping through a supergene enrichment blanket to a

hypogene sulfide zone. Alteration is characterized by central potassic (K

feldspar-biotite), phyllic, and peripheral propylitic zones. Abundant northwest-trending

tensional fractures were superimposed on the porphyry copper-gold deposit and

surrounding areas during the later stages of the evolving mineralized system.

The fractures channeled mineralizing fluids from the central parts of the

porphyry copper deposit outward for up to 5 km. Replacement by adularia and

sericite took place together with deposition of gold-bearing pyrite and minor

amounts of zinc and copper where these fluids encountered permeable dacite

flows and andesite flow breccias. The alteration process caused remobilization

of aluminum and alkalies and addition of K 2 O, which attains values of 12 to

13 wt percent. The Andacollo system is interpreted to be a porphyry copper-gold

deposit that is transitional outward to distal epithermal,

adularia-sericite-type contact metasomatic gold orebodies.